Learn to Tackle Your Debt with These Interest-Reducing Tips!

We must understand that there are interest-reducing ways from which you can reduce the interest on your debts and loans. So, if you’re paying interest on your debt, it’s time to fight back. Fortunately, the options below will help you more than you can even imagine.

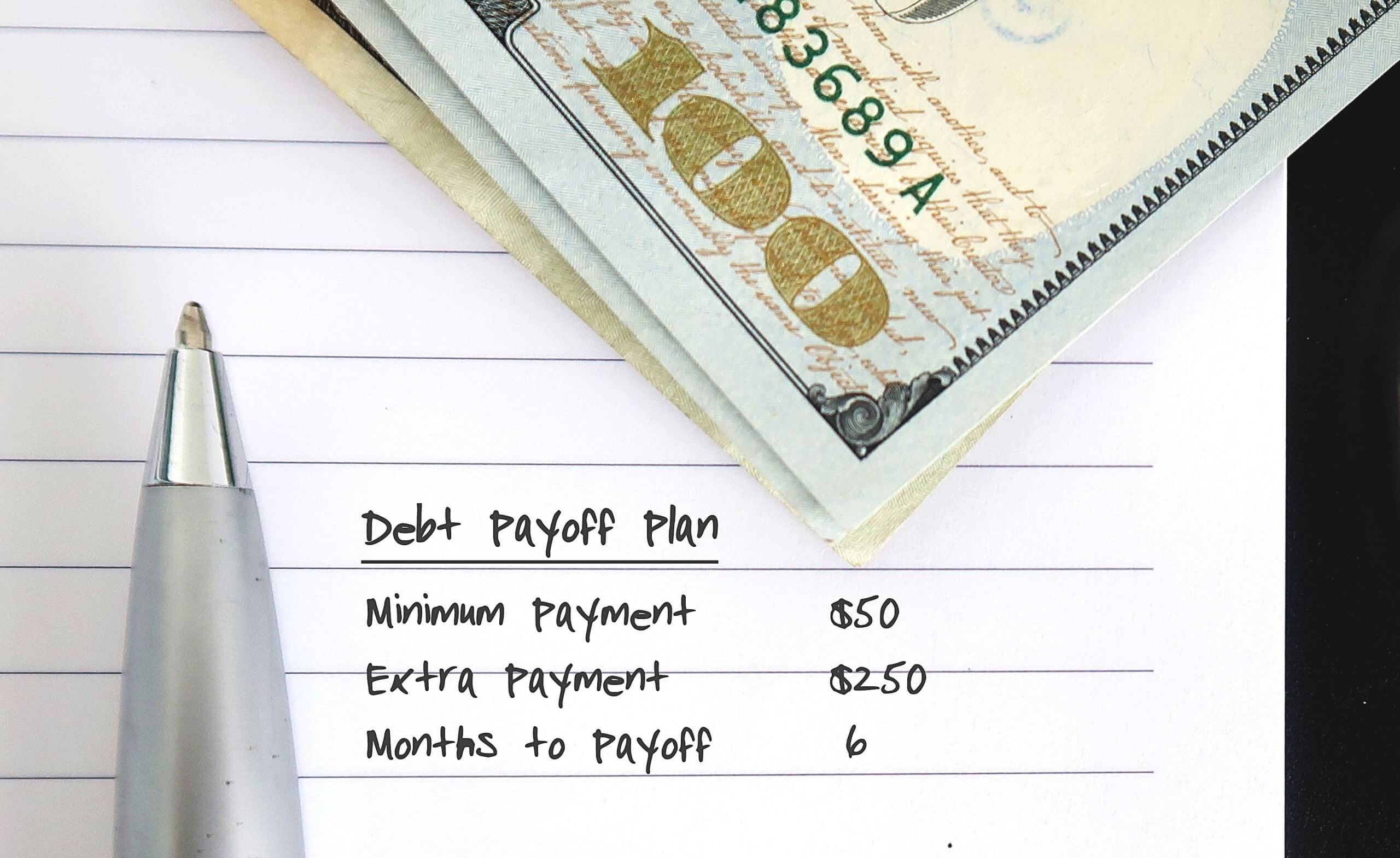

There are many ways to pay debt faster. Still, the problem is that people often don’t take the obligations very seriously, and later, they fall on it while they are paying the debt and forgetting a few months. Still, another mistake they don’t stop is they start taking the debts through which their debts never get down because, on the one hand, they are paying the debt, and on the other hand, they are taking the new debts.

Switch to a 0% credit card

Suppose you are currently paying interest on credit card debt. In that case, it may be more cost-effective to transfer the debt to a credit card that offers this service of zero percent interest on balance transfers during a specific period. I think the best zero percent balance card would still be the money credit card. Many offer zero percent interest for twelve to sixteen months, the most extended zero percent deal on the market. Alternatively, the Barclaycard Platinum with 15-month BT visa offers zero percent on balance transfers for 15 months.

However, when applying for a zero-percent balance transfer card, there are some things to keep in mind:

- For the most extended deals, you must pay a one-time transfer fee (three percent for the Virgin card).

- You will probably only be successful in applying for a card like this if you have excellent credit.

If you don’t do this, you will probably receive a high interest rate on the remaining debt.

It’s worth noting that a few zero-percent balance transfer cards—including Virgin’s offerings—will allow you to lower your interest accounts on non-credit card debt (such as overdrafts or personal loans). This happens through a process called “money transfer.” You can learn more about this in this article.

Make 0% purchase credit card work for you

When you purchase certain financial products, such as one-year insurance, you may be given the option to pay for your coverage in monthly installments. It sounds nice in theory, but these types of tiered payments usually have a nasty sting in the form of substantial interest charges. You will end up paying interest at a rate of 30% APR or even more.

You can avoid these extra costs by paying the total amount right at the start. If you can’t find that large amount, consider getting a credit card offering zero percent interest on new purchases.

So, use your zero percent purchase card to pay your insurance premium in full, then gradually pay the balance on the card over several months. Suppose you settle your debt in total during the zero percent period; the entire transaction should be interest-free.

Find a better current account

Do you receive interest in your overdraft? Finding an account – with a decent zero-percent overdraft facility – is a straightforward way to lower your interest payments. So don’t let sluggishness get the better of you! Many of us stay with the same checking account all our lives, even if it doesn’t meet our needs.

If you’re often in the red, one of the best checking accounts on the market is Alliance & Leicester’s Premier account, which offers a zero percent overdraft facility of up to $2,000 for 12 months.

The account also offers a hundred-dollar bonus to customers who switch to it. This hundred-dollar offer ends in the first week of March, so you’ll need to act if you want to take advantage of it. About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud platform where their QuickBooks™️ file, critical financial documents, and back-office tools are hosted in an efficient SSO environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.

About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud platform where their QuickBooks™️ file, critical financial documents, and back-office tools are hosted in an efficient SSO environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.