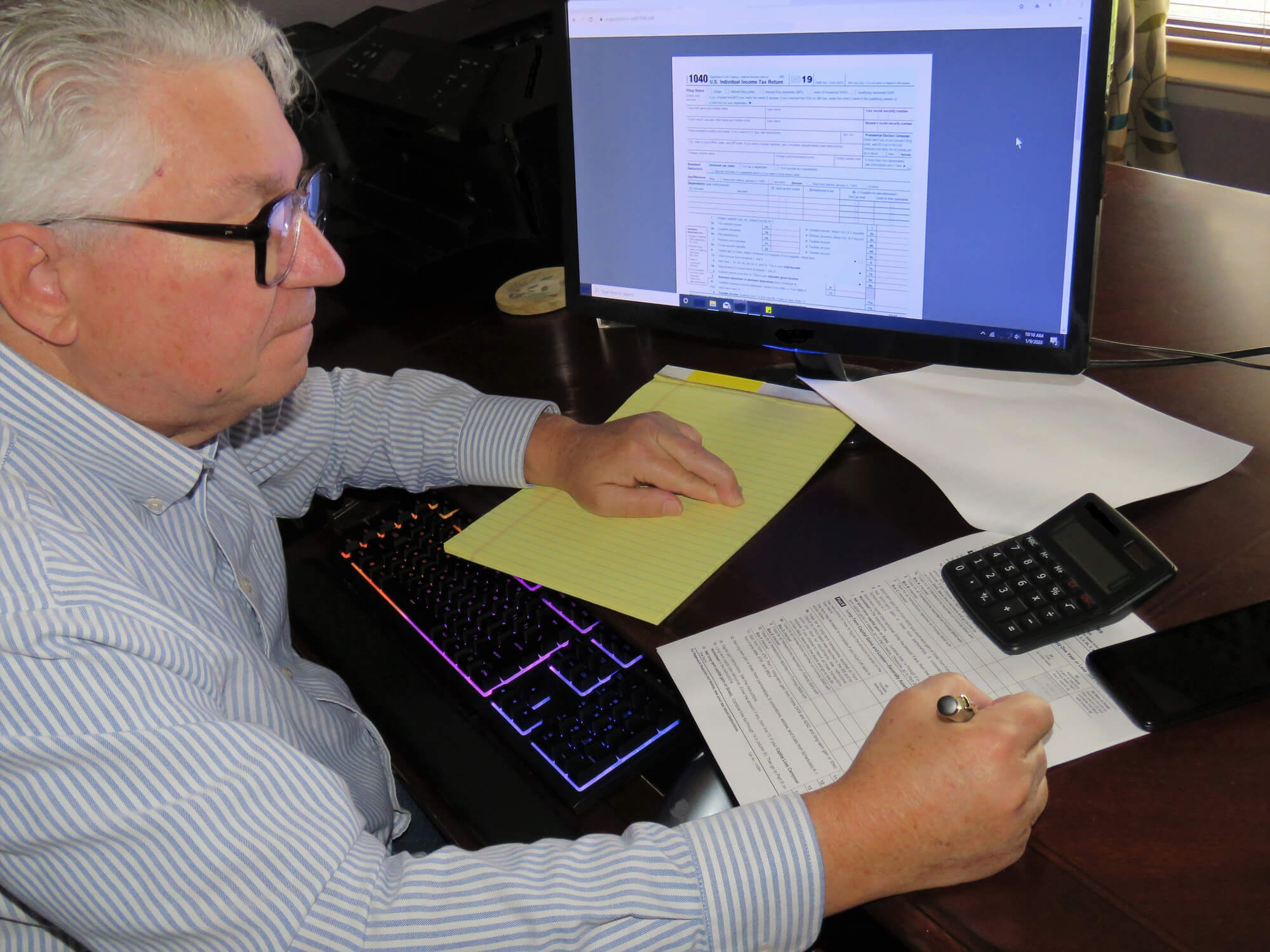

When an entrepreneur runs a business, it is important to hire a professional tax preparer to perform essential tax services. Tax preparers are those professionals responsible for preparing and filing the taxes for your business. The tax preparers’ job is to prepare a detailed evaluation to guarantee that their economic activities are running efficiently. The tax preparer also plays a significant role in maintaining the business functions in a thriving and healthy condition when preparing the business’ taxes.

When starting a business, it is important to ensure that all things involving the business’s accounting are covered, including taxes. Most think only of the general business operations and don’t think ahead to tax preparation. Tax preparation can be done as part of an accountants’ duties, but hiring a tax preparer is a better choice as they will be an expert in tax preparation and give you the greatest benefits at tax time. Here are six justifications for why you should hire a professional tax preparer for your small business.

Helps Save Time

As a business proprietor, numerous essential obligations go into the business’s daily and overall operations. A business owner’s many duties include sales of products and services, marketing, and keeping a budget. A tax preparer is accountable for guaranteeing that the business’s tax needs are being covered. Hiring a tax preparer will permit the business owner to oversee operations to achieve business objectives quickly.

Helps Avoid Costly Mistakes

Because of the number of responsibilities that a business owner has, it becomes really difficult to guarantee that every business operation is correct. There is a great probability that business owners will make some serious mistakes when dealing with the tax filing process in such cases. These mistakes can end up either costing the company a lot of revenue or worse. They can cause it to go completely out of business.

To solve these issues, there is a need for a tax preparer to help the business assess and file taxes that are most beneficial to the business. This tax preparation approach will help the business prevent losses due to errors or missed opportunities.

Helps Deal with Complicated Tax Laws

The process of preparing taxes is considered cumbersome and difficult because of filing taxes. It is crucial to fill out the proper form correctly by providing details, including specifics of accounts, income, expenditures, and payroll. All of these considerations are required to keep the business on the right track. Hiring a tax preparer will help a business owner take care of all these issues efficiently.

Helps Identify Deductions

Hiring a tax preparer will help the business owner identify the potential deductions and provide the best possible advice. This advice will help an entrepreneur to take calculated deductions concerning year-end financial statements. Business owners often neglect those deductions when running day-to-day operations and must figure out the deductions at the end of the year. A tax preparer will help identify these essential deductions.

Helps Reduce Tax Liability

The job of a tax preparer is to recognize and understand tax regulations and laws. They also know the current deductions available for businesses and how to use them. Understanding the deductions, laws, and regulations and finding ways to cut taxes by examining the books will guarantee that the business owes as few taxes as possible. The tax preparer can also look at ways to save on your taxes throughout the year instead of just during tax season.

Helps the Business Grow

Hiring a tax preparer can help a business develop by keeping all the financial facets of the business well recorded. This well-kept data can produce financial statements that will help the business owner understand what kind of capital the business has for growth. With a tax preparer taking care of the business’s financial side, the business owner can concentrate on other business areas, such as operations, and focus on growth.

About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud-hosted desktop where their entire team and tax accountant may access the QuickBooks™️ file, critical financial documents, and back-office tools in an efficient and secure environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.

About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud-hosted desktop where their entire team and tax accountant may access the QuickBooks™️ file, critical financial documents, and back-office tools in an efficient and secure environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.