Calculate the Total Amount You Owe

Although federal and provincial loans are the most common sources of student debt, they are rarely the only sources of debt. Lines of credit for students and amounts owed on their credit cards should also be considered. When creating a repayment plan, it is necessary to compute the entire amount you owe. After knowing how much you owe, you can only build a budget to help you pay off your debt.

Prioritize Your Debts

Prioritizing your bills is critical after determining the overall amount you owe. Look at the interest paid on each obligation and rank them from highest to lowest in terms of importance. You should pay the bare minimum on all your bills and apply any remaining funds to the debt with the highest interest rate. After you’ve paid off that obligation, go after the one with the next highest interest rate, and so on, until you’ve paid off all your debts to ensure that you’ll pay less interest in the long term.

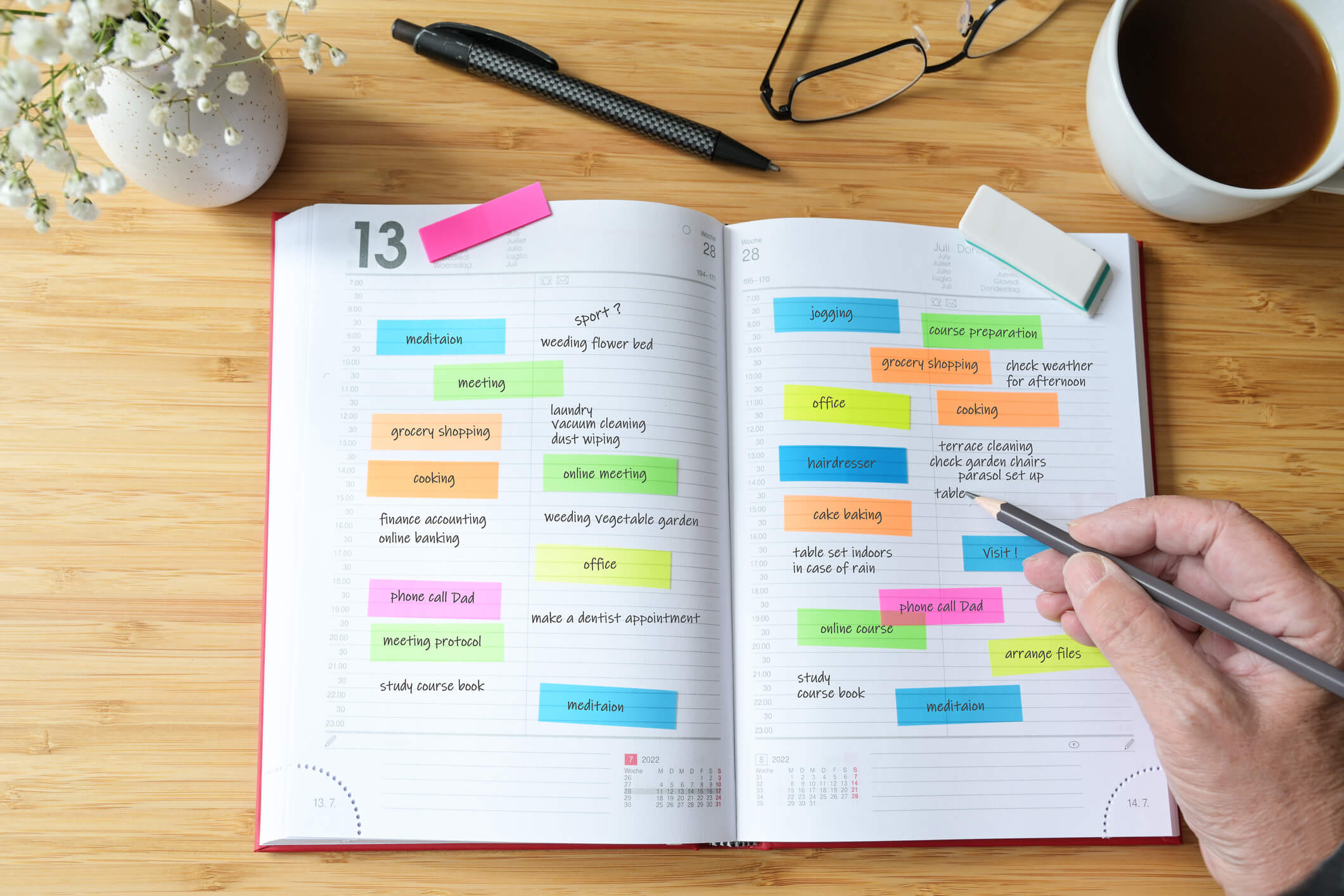

Make a Budget

Creating a budget is the most crucial phase in any repayment plan. A budget will assist you in keeping track of all your costs and correctly managing your finances. Don’t panic if you feel like you’re drowning in debt and can’t seem to climb to the surface. Pay your bills on time every month, even if you can only afford the interest. Not repaying a student loan, like any other debt, can negatively influence your credit score. So, if you’re considering applying for another loan or mortgage, be sure your credit score is in good shape.

Use Assistance Plans

Plenty of solutions are accessible to you if you’re having problems making your payments. You can apply for the Payback Assistance Program and check whether you qualify. It is a loan repayment program where the Government will assist you in repaying your loan. Your income determines the conditions of repayment. In most circumstances, you won’t have to make payments that surpass 20% of your salary. Your monthly student loan payments will be decreased, or you may not have to make any payments, depending on your financial institution.

If you are not eligible for the Repayment Assistance Plan, you can still apply to the Government of Quebec for a Deferred Repayment Plan. As its name implies, the Deferred Repayment Plan allows you to repay your loans according to your income for a maximum of six months if you are unable to adhere to the repayment plan set between you and your financial institution. After six months, you can renew your application with this plan.

Seek Help from a Professional

Don’t hesitate to contact a Licensed Insolvency Trustee if you’ve applied for these plans but don’t qualify and have trouble making ends meet. Your LIT will investigate all your alternatives and assist you in repaying your student debt. After years of studying for a degree, no one should worry about money. The sooner you try to pay off your debt, the sooner you can enjoy a life free of debt.

As a student, you want to manage your financial life as well as possible because you spend a large percentage of your income on fees and other expenses; sometimes, it becomes harder and harder to meet your ends. But by working on the above strategies, you can find something that could help you quickly get rid of your debt.

Overall

Fifty-four percent of bachelor’s degree recipients owe the source an average of $28,000 when they graduate, according to 2015 research by Statistics America. The last thing a student wants to feel after years of arduous study and part-time labor to make ends meet is pressure to take any job to pay off their loans after graduation. As a result, you’ll find the definitive guide to paying off your student debt. About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud platform where their QuickBooks™️ file, critical financial documents, and back-office tools are hosted in an efficient SSO environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.

About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud platform where their QuickBooks™️ file, critical financial documents, and back-office tools are hosted in an efficient SSO environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.