Budgeting and keeping track of your finances can seem impossible. Using a spreadsheet to create a budget worksheet will make budgeting easy! No matter what your financial situation may be, a budget worksheet will be useful to you. Making a budget can seem like a difficult task when you look at your paychecks and bills and wonder if it will even be possible to get through the month. It may be hard to conceive what your potential budget will even look like. You can feel like the numbers will bury you in an unmanageable amount of stress or debt. You do not have to wait for more stability before you face the truth. Having a solid plan will relieve the stress and help you avoid debt. Creating a budget worksheet is fast and easy, and you may already have access to all the tools you need right in Microsoft Excel. If you do not have Excel, there are identical spreadsheet programs available for free online. Whether you spend more than you make or make more than you need to spend, knowing where the money you earn is going each month is vital. Focusing on your spending habits is crucial when thinking about your budget. Also, it is important to know where to direct the money you have left over.

Making a Budget Using a Spreadsheet

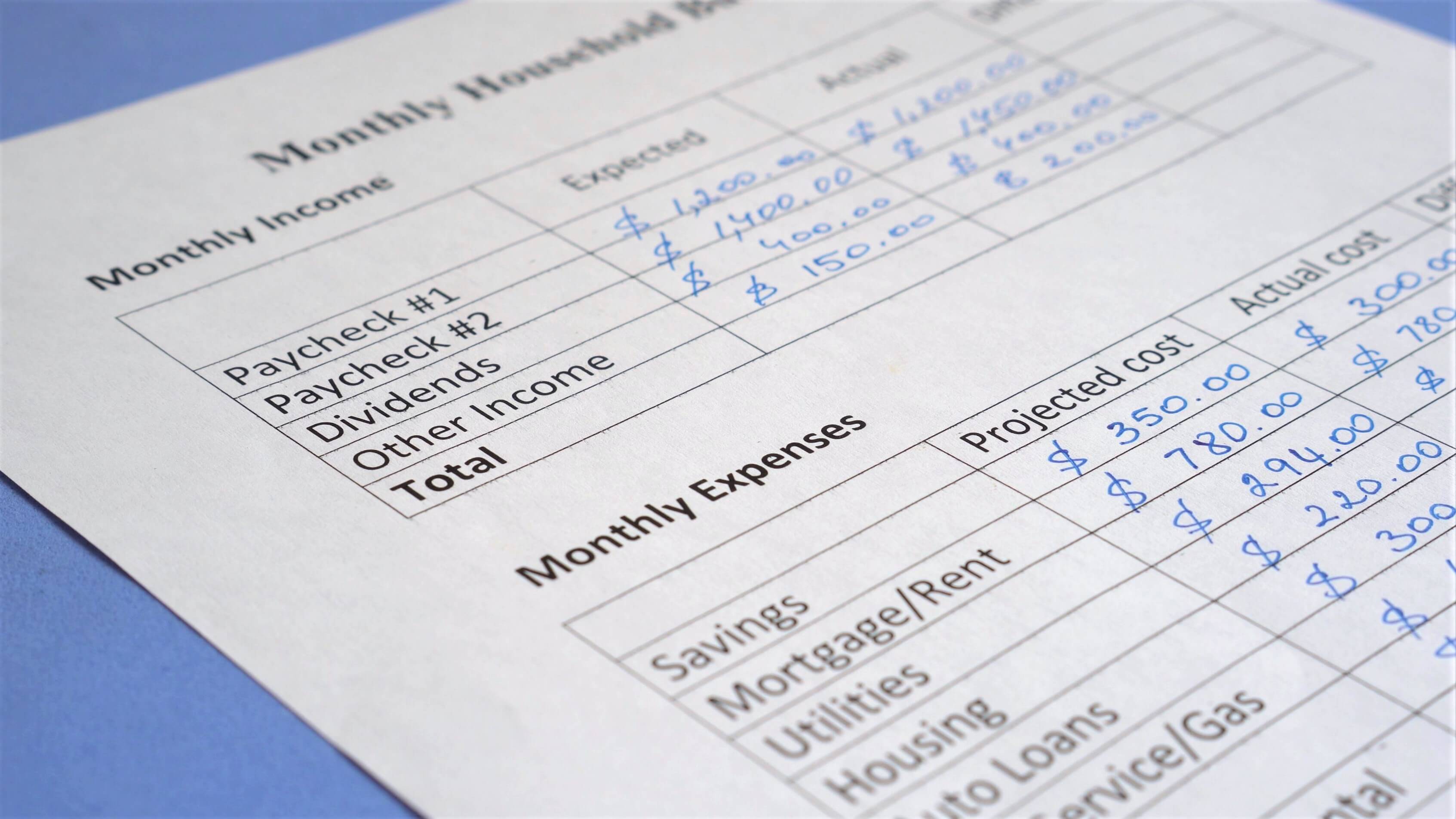

When setting up your spreadsheet, you will have two categories: income and expenses. Both will have three columns: listed sources of income or expenses under the designated category, projected earnings or costs, and actual earnings or costs.

When making a budget, it is important to remember that you will have estimated budget amounts that may differ from your actual expenses. If income or expenses are not a set amount, an estimation will become necessary when setting up the budget columns of the spreadsheet. The suggestion would be to round up to the nearest ten on expenses and round down to the nearest ten for the income estimate. Even if your income or expenses are a fixed amount, this rounding will ensure you do not spend more than your means and also that you have adequate coverage of your expenses.

Under income, in the first column, you will add all your sources of income. This could include your paycheck, cashback on credit cards, financial aid, or other allowances, each of them in their own row. In the next column, “Projected Income”, you will add what you expect to earn in each of these categories. In the last column, “Actual Income”, you will enter what and when you received your respective earnings.

Under expenses, in the first column, you will add all your expenses in the same way you listed your income. You will also add the projected cost of each item and the actual cost after receiving the bill. You can list your expenses two ways, by largest to smallest or by due date. This will be dependent on what works best for you.

Most spreadsheet programs will total each column automatically. These totals can now be compared to determine whether your income exceeds your expenses or your expenses exceed your income. Knowing this will help you make smarter spending and saving decisions. If you have a surplus at the end of the month, you can put it in savings, spend it on items you desire, or take a vacation. If you have spent more than you make, you can use the spreadsheet to identify expenses that can be reduced or cut out.

No matter what your financial situation may be, making and keeping a budget should be a priority. This type of personal bookkeeping can make a difference in your bottom line while also positively affecting your future financial health. Now that you can see that creating a budget worksheet is easy, you can view it as a worthy tool to help control your finances and live stress-free.

About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud-hosted desktop where their entire team and tax accountant may access the QuickBooks™️ file, critical financial documents, and back-office tools in an efficient and secure environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.

About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud-hosted desktop where their entire team and tax accountant may access the QuickBooks™️ file, critical financial documents, and back-office tools in an efficient and secure environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.