Whether you are storing your money in a bank account or a safe deposit box, both are under the security of a bank. This is where the similarities between the two end.

Bank accounts are the preferable means of storing money for both customers and the bank. The customers can withdraw the funds in bank accounts at any time. And the banks are at an advantage here as they can use the money in their own activities and investments and give it back when the customer withdraws it.

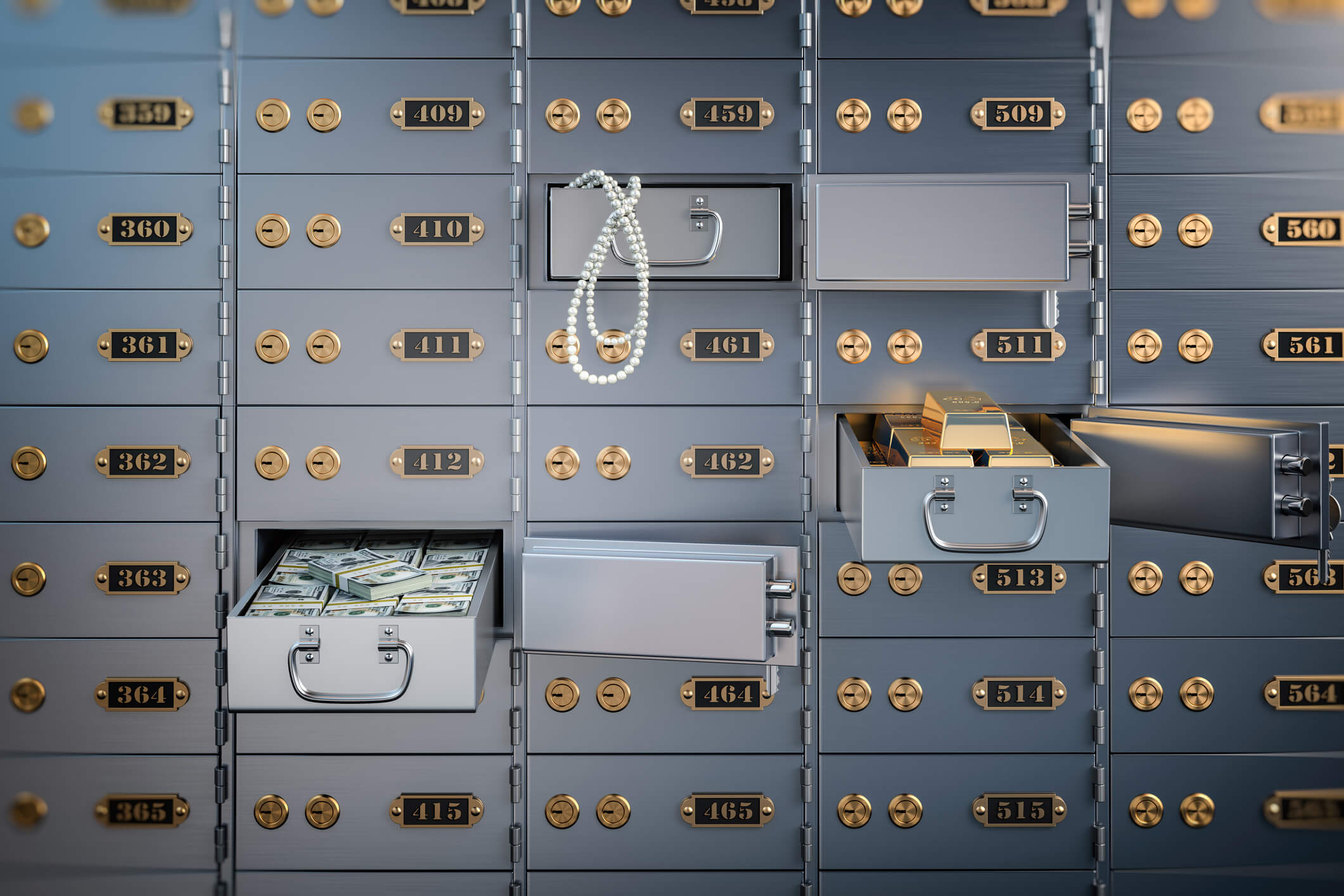

Safe deposit boxes, also known as lockers, are used by people who want to store valuables such as paintings, jewelry, other valued items, and sometimes cash.

Here is a comparison of safe deposit boxes (lockers) and bank accounts:

Safe Deposit Box (Locker)

Advantages

- It can be used to store gold bars, jewelry, collectibles, and any other valuables; unlike bank accounts, you can’t just withdraw or deposit cash.

- Harder to break into and are kept under maximum security in the bank behind numerous locks, an automated door, CCTV, and of course, the bank guards. Furthermore, no one is allowed to access these lockers without keys that are only in possession of the locker’s owner and bank manager.

- It can be emptied of their contents and valuables, all in one go.

- Much safer than other options and are only at risk at the time of a robbery.

Disadvantages

- No one, not even the owner, can access the locker without owner and manager’s keys.

- If you rent a safe deposit box at a bank, you will be charged a fee for the security and maintenance of your locker and everything in it.

- Unless you have cash in your locker (which can only be accessed during the banks operating hours), this asset is considered to have low liquidity.

- Record of the money in bank accounts can be tracked and valued in bookkeeping, but there is no record of the items that are kept in the locker, to maintain the owner’s

Bank accounts

Advantages

- Bank accounts have high liquidity, and the money in it can easily be withdrawn, or you can easily make payments through pay orders, checks, and

- Money can be withdrawn from the bank through checks during working hours, or through ATMs at any time.

- Bank pays interest (higher interest rates on savings accounts in comparison to current accounts) on the money in your account as they invest it or loans it, other No matter what, you can withdraw your money at any time.

Disadvantages

- There is a specific cycle limit or per day for withdrawal, which cannot be exceeded through ATM. The cycle limit depends on the type of account you have and the bank you have your account in.

- Transactions can be made by anyone using your debit and credit cards, which makes this unsafe. If your credit card (linked to the bank account) is stolen, they can easily make transactions through it, and you would still be liable for them. If your debit card is stolen, then it is harder because they will have to know your pin to make withdrawals from ATMs, unless it is a VISA or MasterCard that can be swiped like a credit card.

- Online scammers can easily target bank account and credit card information.

Now that you know all the possible pros and cons of both lockers and bank accounts, which do you think is preferable for you?

In our opinion, if you want to save cash or mostly do money transactions, then opt for a bank account; but if you’re going to safeguard something else like gold bars or some important documents, then go for lockers. On a side note, if you are storing important documents in the locker, then keep a copy of them with you just in case.

About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud-hosted desktop where their entire team and tax accountant may access the QuickBooks™️ file, critical financial documents, and back-office tools in an efficient and secure environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.

About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud-hosted desktop where their entire team and tax accountant may access the QuickBooks™️ file, critical financial documents, and back-office tools in an efficient and secure environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.