As a business owner, managing your finances should be your priority on your to-do list. You have to focus on inventory, manage accounting and bookkeeping, and other financial tasks in front of you. But all these functions require clarity in your financial statements and bookkeeping records.

Delayed or missed entries in business bookkeeping can pave the way to financial disaster and business failure. Building a clear picture of your financial health will contribute to business growth. If a business is ready to audit, it attracts investors.

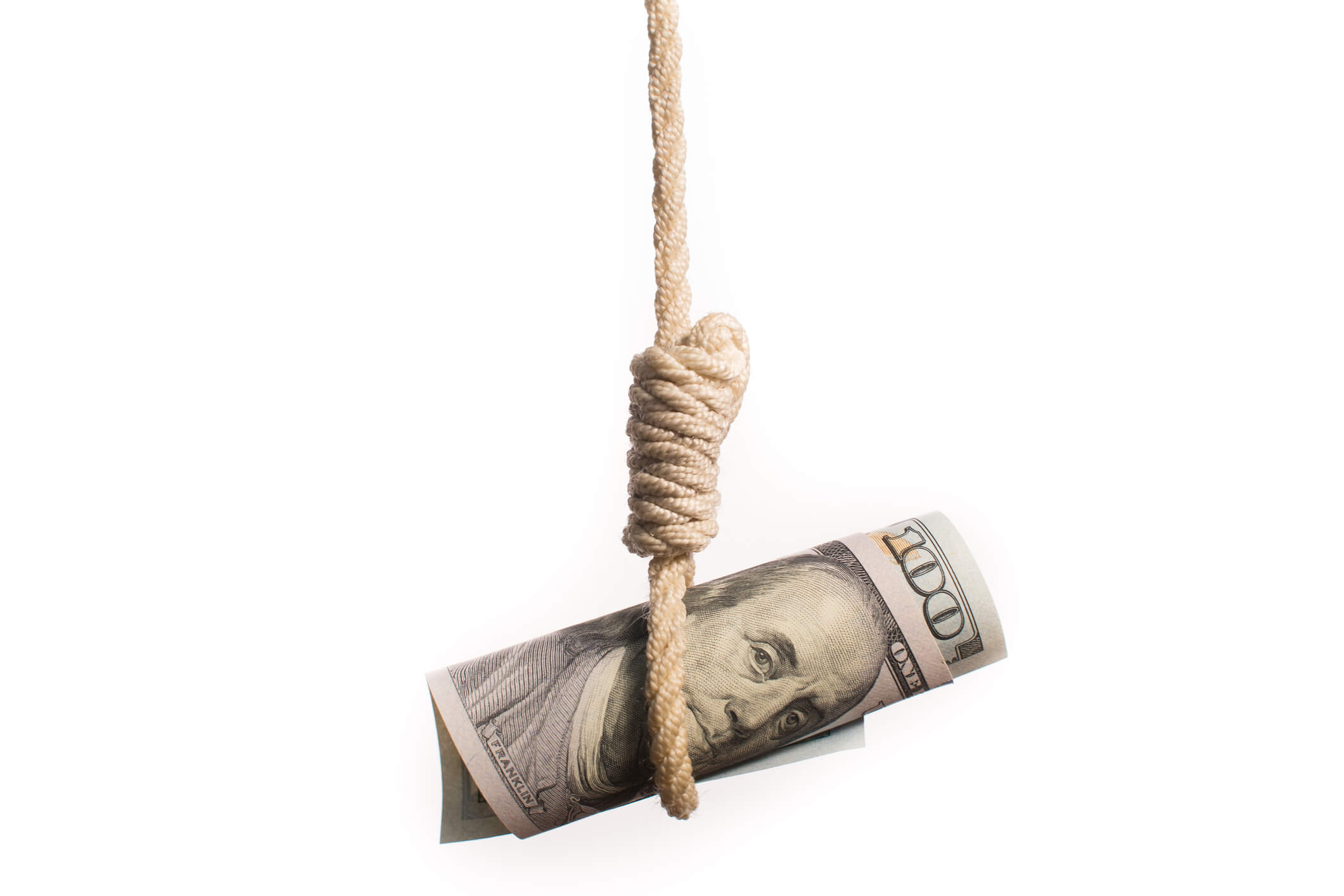

Accounting Problems That Can Sink Your Funding

You do not use an accounting software

Manual work is always the hardest and is at risk of errors. A small accounting error can lead to considerable losses in the business. An accounting software, according to your business size, is as essential as funding your business. Small business owners can also get specific software to meet their needs.

Working on a spreadsheet is not like working in accounting software. Be sure to research and find the appropriate accounting software to make your business bookkeeping run smoothly.

Financials are incorrect

Incorrect financials are a threatening accounting problem in your business. If your finances are wrong, it may sink your funding round in your business.

Any error in financial statements leads to considerable losses. Business bookkeeping and other business operations will be messy if you do not keep your financial data current. Your accounting statements must be clear and transparent. Income and expense statements must be clear and related to cash flow and balance sheets. Delayed data entry is a significant risk for fraud and theft.

There are projections for revenue, but there is no financial data

You cannot have a clear picture of how much revenue your business has generated unless you know the expenses and purchases you have made. Your sales have increased, but is that according to the profitability of your business? Investors want to get a clear and transparent presentation of your financial data to invest their money. A business loan cannot be achieved from banks unless a clear, transparent financial record of your company is present.

Financials are not produced monthly

In a small business, it is often thought that it is appropriate to produce finances on a quarterly or bi-annual basis. However, monthly financials show investors that you are closely monitoring your business.

If you do not produce monthly financial statements, a negative balance can result if expenses are made but no income statement is updated. Invoices that need to be paid by the company may go unnoticed, which can damage a company’s reputation. It can also end terms with suppliers, halting or significantly reducing business growth.

Your personal and business accounts are all mixed up

Business owners often mix their personal finances with business expenses. Keeping these two finances separate is of utmost importance. If these two finances (personal and business) are not segregated, then it cannot be known what was intended for business and what was used personally. The amount of profit that was generated out of your invested capital cannot be estimated correctly.

Your funding will sink if you do not keep a separate business account.

Conclusion

As a small business owner, you have the drive to grow your business at lightning speed! However, it’s important to keep in mind that accurate financial records are essential to success. Don’t overlook accounting issues during the initial stages of your business. If you do, it could negatively impact your funding prospects and harm your ability to secure funding. Stay on top of your finances and watch your business grow with confidence!

About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud platform where their QuickBooks™️ file, critical financial documents, and back-office tools are hosted in an efficient SSO environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.

About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud platform where their QuickBooks™️ file, critical financial documents, and back-office tools are hosted in an efficient SSO environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.